*This article was written on assignment in February 2020 in India with Photographers Without Borders for Sambhali Trust. For more information on Photographers Without Borders, visit www.photographerswithoutborders.org/. And for more information on Sambhali Trust, visit their homepage.

Women in Rajasthan, India are discovering the peace of mind that comes with financial independence. In Rajasthan, which is ranked the 3rd worst state for women to live in India, Sambhali Trust is an NGO focused on the development and empowerment of marginalized women and girls. Sambhali is tackling deep-rooted gender stereotypes and poverty by equipping women with resources to support their families through a unique micro-financing program.

Overwhelmingly, women in India are disenfranchised. They are destined to a life of taking care of the home, which includes not only her husband and children but also her husband’s parents all under one roof.

Meera’s husband left rural Setrawa 10 years ago in search of economic opportunity and employment. Since living in Surat, her husband has only made enough money to pay his own rent and bills.

Therefore, Meera has been left to find ways to support herself and her in-laws. And more recently, Meera’s husband lost his job completely, leaving Meera to be the breadwinner and sole income provider for the entire family.

The financial stress of her situation is not uncommon in India. Sadly it’s the norm. Families often find themselves needing to borrow money from banks or private lenders as issues arise such as home repairs or medical needs.

Bank loan rates in India run anywhere from 5-10% and require monthly payments. Due to a lack of clarity when signing for bank loans, Indians will often find themselves drowning in debt quickly.

And they’ll soon be asking a family member, neighbor, or friend for a loan at a slightly lower interest rate to help pay off the bank loan. This, of course, leads to a debt snowball effect.

Families will mortgage gold jewelry, and even children in order to pay off debts. More broadly, indebtedness is the leading contributor to India’s bonded labor crisis. The 2016 Global Slavery Index reported there were 18.3 million people living in modern slavery in India, the most in the world.

But Meera is finding ways to take control of her life and inspiring other women in Setrawa to do the same. Not only does she own two local shops, but she also earns money teaching at the Sambhali Trust Primary Education Center each afternoon.

In 2013, she asked the Sambhali Trust for a loan to pay for some home repairs and recognized a promising opportunity.

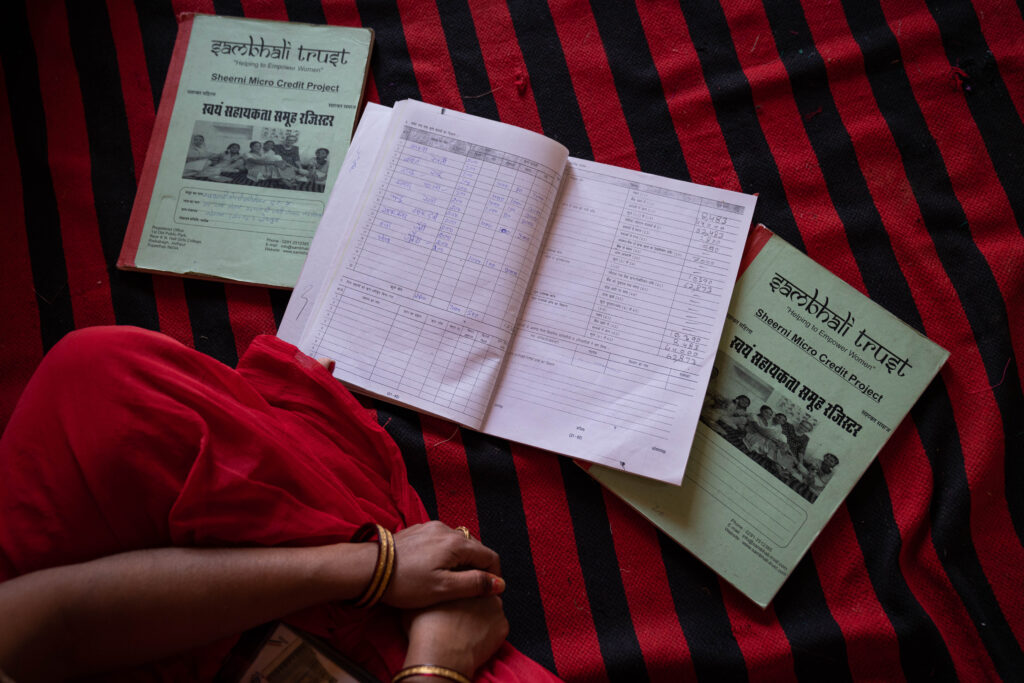

She created and now manages 8 microcredit groups of 105 women in the Setrawa desert for the Sambhali Trust. It’s her responsibility to determine who enters the program and to guide them along the way.

In stark contrast to Indian banks, the Sambhali Microcredit loan rate is a decreasing 1%. This means that as long as you are making monthly loan payments, your rate continues to go down by 1/10th of a percent until the loan is successfully paid back.

The success of the program in rural Setrawa inspired action in the city of Jodhpur. Vimlesh, who runs many local programs for Sambhali Trust, visited Setrawa to learn directly from Meera. And she now manages 3 of her own Sambhali Microcredit groups in Jodhpur.

Like Meera, Vimlesh is the first woman in her family to work outside of the home and a first-generation female breadwinner!

She’s a natural role model for the women of Sambhali and they trust her with some of their most difficult problems. Vimlesh shared that “the women trust me to be kind.”

One such woman, Rekha, is a beneficiary of the microcredit program. She uses her Sambhali Loan to purchase necessary medicine for her disabled son.

It’s given her peace of mind knowing she can take a loan from a woman she trusts with a low rate that will not create additional stress in her life. Not only that, but it allows her to truly enjoy the time she spends at Sambhali’s Graduate Center sewing various products for the Sambhali Boutique.

Meera and Vimlesh are true change agents! They are working to break the cycle of poverty by instilling confidence in the women they mentor through the Microcredit Program.

And their mission is having a ripple effect on the next generation. Meera’s own daughter is now a beneficiary of Sambhali Trust’s empowerment programs. She’s following in the footsteps of her mother.

If you want to link arms with Meera to foster financial independence and can truly see why female empowerment is important, remember the microcredit 1% loan rate and donate 1% of your paycheck today to Sambhali Trust by clicking here!

April 12, 2023

|

Hey There! I'm Hilary Lex

I’m here to help women step into adventure and feel confident on the trail. With years of backpacking experience, I’ve created Hilary Lex Treks to guide you on unforgettable journeys through wild places like Glacier National Park. Whether you’re just starting or ready to take on a new challenge, I’m here to support you every step of the way. Let’s get you out there and make your adventure a reality.

Stay in Touch

Letters about my latest adventures, obsessions, and industry news – just a little something to invite bewilderment into your daily life.